Accounts Payable Approval Process: Complete Workflow, Controls, and Best Practices

The accounts payable approval process defines how organizations authorize, verify, and release supplier payments. It ensures financial accuracy, fraud prevention, and compliance with internal controls. Every company that manages expenses, vendor invoices, or purchase orders depends on a structured AP workflow to maintain fiscal integrity and operational transparency.

Definition and Core Function

What Is the Accounts Payable Approval Process?

The accounts payable approval process is a structured sequence where invoices are received, validated, approved, and processed for payment. It involves cross-verification among procurement, finance, and management teams. The process enforces accuracy between purchase orders (POs), goods receipts, and vendor bills before disbursement.

Why the Approval Process Matters

This process acts as a safeguard against duplicate invoices, overpayments, and fraudulent transactions. It confirms that expenditures align with authorized budgets and contract terms. According to the Institute of Finance and Management (IOFM), efficient AP approval workflows reduce invoice processing costs by up to 65%, improving liquidity control and vendor relationships.

Key Entities and Stakeholders

-

Accounts Payable Department: Handles invoice entry, validation, and scheduling.

-

Procurement Department: Confirms goods or services delivery against POs.

-

Department Managers: Authorize expenses within departmental budgets.

-

Finance Controllers: Verify accounting codes and compliance with audit policies.

-

Vendors and Suppliers: Submit invoices and await approval notifications.

-

Internal Auditors: Ensure segregation of duties and approval consistency.

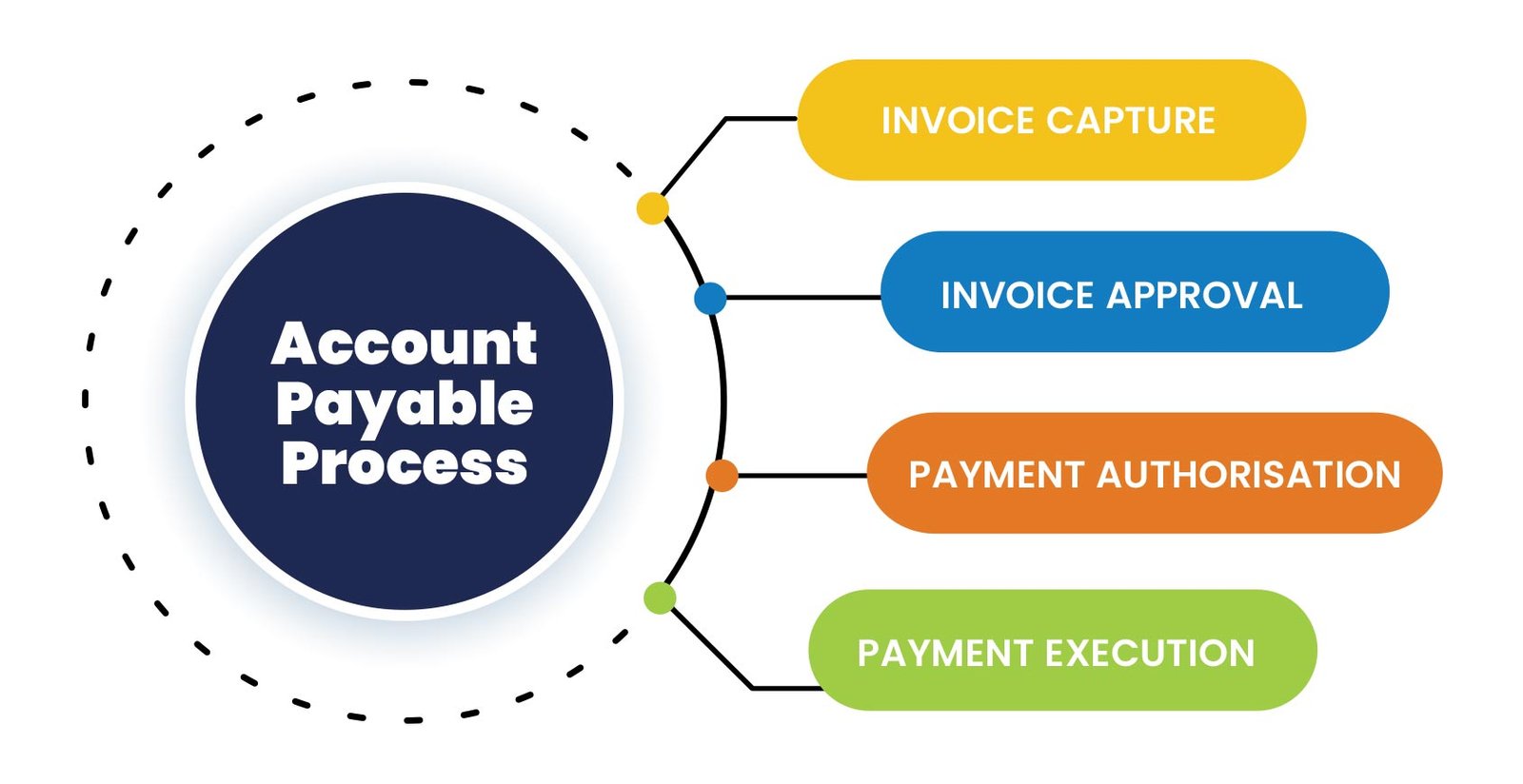

Stages of the Accounts Payable Approval Workflow

| Stage | Action | Responsible Entity | Verification Method |

|---|---|---|---|

| 1. Invoice Receipt | Capture invoice from supplier (email, EDI, or portal) | AP Clerk | Source validation |

| 2. Data Entry | Record invoice details in ERP or AP system | AP Team | OCR / Manual Entry |

| 3. Matching | Compare invoice with PO and goods receipt | Procurement | 2-way or 3-way match |

| 4. Approval Routing | Send to authorized approver based on hierarchy | Department Manager | Policy-based routing |

| 5. Exception Handling | Resolve mismatches, price variances, or missing POs | AP Specialist | Communication with vendor |

| 6. Final Approval | Confirm payment release readiness | Finance Controller | Electronic signature |

| 7. Payment Execution | Process through ACH, check, or wire transfer | Treasury | Payment run batch |

| 8. Archiving | Store invoice and approval log for audits | AP Department | ERP document management |

Detailed Breakdown of Each Stage

1. Invoice Receipt and Capture

Organizations receive invoices via paper mail, email attachments, or automated supplier portals. Advanced systems use Optical Character Recognition (OCR) to extract invoice data. ERP systems like SAP, Oracle NetSuite, and Microsoft Dynamics 365 integrate AI-based invoice capture for faster entry and reduced human error.

2. Data Validation and Indexing

Data validation ensures accuracy in invoice fields such as vendor ID, invoice number, date, and tax details. The system checks for duplicates and compliance with regional tax authorities like GST, VAT, or IRS 1099 requirements. Proper indexing enables traceability during audits and reporting cycles.

3. Three-Way Matching Process

A three-way match compares the purchase order, goods receipt, and supplier invoice. This method verifies:

-

Quantity ordered matches quantity received.

-

Unit prices align with the PO.

-

Invoice totals reflect approved terms.

Failure to match triggers exception handling, requiring manual review.

4. Approval Routing Rules

Automated routing defines who approves which invoice based on:

-

Monetary limits (e.g., up to $10,000 for departmental managers).

-

Cost center codes (to allocate expenses).

-

Project numbers (for capital expenditures).

Systems like Coupa, Tipalti, and AvidXchange offer configurable workflow engines that maintain audit trails and approval hierarchies.

5. Exception Management

Exceptions arise due to:

-

Missing purchase orders.

-

Incorrect quantities or prices.

-

Unapproved vendors.

-

Budget overruns.

Resolution requires communication between the AP clerk, procurement team, and supplier. Automation tools flag anomalies for investigation, reducing cycle time.

6. Final Approval and Authorization

Once exceptions are cleared, invoices route to the finance controller or CFO. Approval is granted through secure e-signature systems like DocuSign or Adobe Acrobat Sign. This digital authorization ensures traceable compliance under frameworks like SOX (Sarbanes-Oxley Act).

7. Payment Execution and Reconciliation

Payments are processed using:

-

Automated Clearing House (ACH)

-

Wire Transfers

-

Virtual Cards

-

Checks (for legacy systems)

Each payment batch undergoes reconciliation against bank statements. Systems use API integrations with banking networks to sync real-time payment statuses.

8. Archival and Audit Readiness

Invoice documents and approval logs are archived digitally in ERP systems. Retention policies comply with accounting standards such as GAAP and IFRS. This enables fast retrieval during internal audits or external financial reviews.

Automation in the Accounts Payable Approval Process

Automation tools reduce manual workloads by introducing:

-

AI-powered data extraction

-

Intelligent routing and reminders

-

Real-time dashboards

-

Integration with procurement and general ledger modules

Top AP Automation Software Platforms

| Platform | Core Feature | Integration | Industry Focus |

|---|---|---|---|

| SAP Ariba | Full PO-to-Pay automation | SAP ERP | Enterprise |

| Tipalti | Global supplier payments | NetSuite, QuickBooks | SaaS and E-commerce |

| Stampli | Invoice collaboration hub | ERP connectors | Mid-market |

| Airbase | Spend control & approval workflows | Xero, QuickBooks | SMEs |

| AvidXchange | Paperless invoice management | MS Dynamics | Manufacturing |

Automation reduces invoice cycle time from 14 days to less than 2 days, according to APQC Benchmarking Research (2024).

Compliance and Risk Management

Internal Controls

The process enforces segregation of duties (SoD). For example:

-

The invoice creator cannot approve payments.

-

The approver cannot release funds.

-

Auditors independently verify compliance.

Fraud Prevention

Controls include:

-

Vendor validation through OFAC and AML checks.

-

Duplicate invoice detection.

-

Automated alerts for suspicious vendor behavior.

Regulatory Compliance

The AP process aligns with:

-

SOX 404 for financial transparency.

-

FCPA for anti-bribery enforcement.

-

GDPR for supplier data protection.

Compliance automation ensures readiness for statutory audits and financial reporting accuracy.

Metrics and Performance Indicators

Key Performance Indicators (KPIs)

| KPI | Description | Ideal Benchmark |

|---|---|---|

| Invoice Cycle Time | Time from receipt to payment | < 5 days |

| Cost per Invoice | Total AP cost ÷ invoices processed | < $3 |

| On-Time Payment Rate | Percentage of invoices paid before due date | > 95% |

| Exception Rate | Ratio of invoices requiring manual intervention | < 10% |

| Early Payment Discounts Captured | Savings from early settlements | > 85% |

Tracking these KPIs supports continuous improvement and executive decision-making.

Benefits of a Structured Approval Process

1. Cost Efficiency

Automation minimizes manual data entry, reducing administrative costs by up to 80%.

2. Accuracy and Transparency

A centralized workflow eliminates human errors and creates full visibility for auditors and CFOs.

3. Strong Vendor Relations

Consistent payment schedules enhance supplier trust and improve contract terms.

4. Fraud Reduction

Digital trails deter unauthorized payments or manipulation of invoice data.

5. Scalability

The system scales effortlessly with business growth, multi-entity structures, and global operations.

Challenges in Traditional AP Approval

-

Paper-Based Invoicing: Increases data entry errors.

-

Manual Routing: Slows down approvals.

-

Lack of Visibility: Causes missed payment discounts.

-

Disjointed Systems: Hinders reconciliation accuracy.

-

Compliance Risks: Exposes organizations to audit failures.

Modern AP platforms eliminate these issues through unified digital frameworks.

How to Improve the Accounts Payable Approval Process

1. Standardize Invoice Formats

Ensure all vendors follow uniform invoice templates with mandatory fields.

2. Implement Automation Software

Adopt AI-driven AP systems to manage large invoice volumes efficiently.

3. Define Clear Approval Hierarchies

Establish financial authority thresholds for faster decision-making.

4. Integrate ERP and Procurement Modules

Eliminate data silos by linking procurement, AP, and general ledger systems.

5. Conduct Regular Audits

Schedule quarterly audits to review exceptions and control adherence.

6. Train Staff

Continuous training ensures compliance with policies and software updates.

7. Monitor KPIs

Analyze metrics monthly to identify bottlenecks and performance trends.

Real World Example: Corporate Implementation

Entity: Global Manufacturing Corporation

Tool: SAP Ariba with machine learning extensions

Impact:

-

Reduced processing time from 10 days to 1.8 days

-

Improved discount capture rate by 37%

-

Eliminated 98% of duplicate invoices

This transformation demonstrated that technology-driven workflows directly improve working capital management.

Future Trends in Accounts Payable Approval

-

AI-based Predictive Approvals: Machine learning models predict approver decisions to accelerate workflow.

-

Blockchain Ledger Integration: Immutable records strengthen audit traceability.

-

Embedded Analytics: Real-time insights help CFOs manage liquidity.

-

Touchless Invoicing: 100% automation without human interaction.

-

ESG Reporting Alignment: Sustainability-linked supplier payments become part of AP metrics.

Conclusion

The accounts payable approval process is fundamental for financial governance and corporate efficiency. By standardizing workflows, enforcing controls, and adopting automation, companies achieve faster invoice cycles, improved compliance, and stronger vendor partnerships. Continuous monitoring and technology adoption ensure sustainable, transparent, and audit-ready operations.

Learn More: What Is Single Instance Storage: The Ultimate Guide for 2025

Rosemary Oil Suppliers: Global Leaders, Quality Standards, and Sourcing Insights

Frequently Asked Questions (FAQs)

1. What Is the Purpose of the Accounts Payable Approval Process?

To verify invoice authenticity, authorize legitimate payments, and maintain accurate financial records.

2. What Are the Main Steps in the AP Approval Workflow?

Invoice receipt, validation, matching, approval routing, exception handling, final approval, and payment execution.

3. How Does Automation Improve AP Approval?

Automation eliminates manual entry, reduces cycle time, and ensures audit compliance through digital traceability.

4. What Is a Three-Way Match in AP?

It compares the purchase order, goods receipt, and supplier invoice to confirm transaction legitimacy.

5. Who Approves Invoices in an Organization?

Typically, department managers, finance controllers, or authorized signatories approve invoices based on defined limits.

6. What Are Common AP Process Risks?

Duplicate payments, unauthorized invoices, fraud, and late payment penalties.

7. How Do Companies Ensure Compliance in AP?

Through segregation of duties, audit trails, and adherence to regulatory frameworks like SOX and FCPA.

8. What Tools Are Used for AP Automation?

Popular tools include SAP Ariba, Tipalti, Airbase, and AvidXchange.

9. What Is an Example of an Approval Hierarchy?

Invoices below $5,000 may be approved by a manager, while invoices above $50,000 require CFO review.

10. How Can Businesses Improve the AP Process?

By integrating ERP systems, adopting automation, defining clear policies, and tracking KPIs regularly.